The CSRD Directive sets out the content of future sustainability reports for European companies subject to the Directive. There are a number of major changes compared with the previous Directive: the scope of companies subject to the Directive has been broadened, publication requirements have been increased and auditing is required. How can European real estate players anticipate these regulations?

What are the implications of the CSRD Directive?

The Directive on Corporate Sustainability Reporting (CSRD) marks a major step forward in the European regulatory landscape. Its adoption in December 2022 aims to increase the transparency of companies’ environmental and social impacts, and their consideration of sustainability risks. It forms part of the wider European legislative framework on sustainability, underlining the EU’s ongoing commitment to a more sustainable economy. The Directive will apply progressively from 2025 (on financial year 2024) to European and non-European listed companies operating in the EU. The application thresholds will be defined by each Member State.

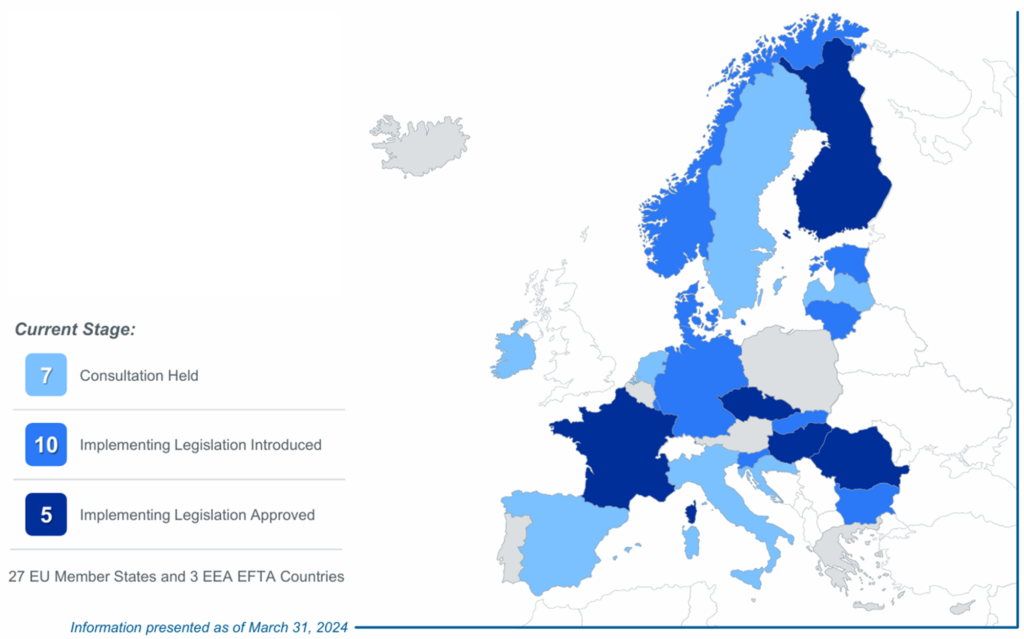

The Directive is currently being transposed into the national law of the Member States (see graph below). Only 5 European countries have already transposed the CSRD into national law. For most of them, the legislative process is well underway, and approval is still pending. 7 Member States are still in the consultation phase, less than a year away from the requirement to publish agnostic standards for the first players subject to the directive.

The national transpositions of the CSRD allow for the local transposition of the thresholds for the players subject to the Directive, the bodies authorised to audit the sustainability reports and the penalties provided for in the event of non-compliance with the requirements. However, the content of the sustainability reports is set by the standards resulting from Delegated Regulation (EU) 2023/2772 of 31 July 2023. These standards, known as ESRS for European Sustainability Reporting Standards, are not transposed nationally, as they are set by Regulation (and not Directive).

The state of transposition in Member States. Source: Ropes & Gray CSRD Transposition Tracker, March 2024

In the property sector, where environmental and social impacts are tangible, CSRD is of particular importance. Indeed, buildings have a significant impact on the environment, human health and well-being (European Commission). As a result, there is a clear need for greater transparency and accountability in this sector. Companies in the real estate sector need to anticipate these regulations.

Impact on real estate players

The implementation of the CSRD will have a major impact on European real estate players. On the one hand, it will require more rigorous data and a better risk management. Companies will need to invest in robust data collection, and analysis systems to meet reporting requirements. In addition, ESG risk management will need to be proactively integrated into business strategies to mitigate principal adverse impacts and seize opportunities related to sustainability.

On the other hand, CSRD will influence access to finance as well as the valuation of real estate assets. Indeed, investors are increasingly sensitive to ESG criteria when making investment decisions. As a result, real estate companies that adopt sustainable practices will be better positioned to attract financing and benefit from higher asset valuations.

Faced with these challenges, real estate players need to develop effective adaptation strategies. This includes developing a comprehensive non-financial reporting strategy, which must be based on the elements already mentioned: strengthening data collection methods and the capacity for detailed analysis. In addition, companies will have to address challenges such as staff training and raising awareness of ESG issues.

However, these challenges also present opportunities. Companies that adopt sustainable and transparent practices can benefit from significant competitive advantages. In addition, innovation in products and services to meet CSRD requirements can open up new business opportunities and enhance a company’s reputation.

Conclusion and Recommendations

In conclusion, the implementation of the CSRD will have profound implications for real estate players in Europe. As companies strive to comply with this Directive, it is essential to recognise the opportunities it offers to drive innovation and strengthen sustainability in the sector. By taking a proactive approach and investing in sustainable practices, real estate players can not only meet regulatory requirements, but also position their businesses for long-term sustainable growth.

About us:

The Green Building Observatory (OID) has launched a European programme in 2021, the European Sustainable Real Estate Initiative (ESREI), that brings together real estate stakeholders to discuss ESG issues and the situation regarding ESG regulations across Europe.

ESREI is now sponsored by AEW, Amundi Asset Management, Axa Investment Managers, BNP Paribas Real Estate, CBRE Global Investors, Ivanhoe Cambridge, La Française REIM, Mazars, Ofi Invest and Pimco Prime Real Estate.

Contact the ESREI team at esrei@o-immobilierdurable.fr if you are interested to join us!