In March 2018, the European Commission launched its Sustainable Finance Action Plan to redirect financial flows towards the ecological transition. Since then, the European regulatory landscape has been evolving rapidly about sustainable finance. Two major pieces of legislation follow on from this action plan: the Taxonomy Regulation and the SFDR Regulation, with extra-financial transparency as their cornerstone. The European Taxonomy has become the benchmark for determining whether an economic activity is environmentally sustainable. The SFDR (Sustainable Finance Disclosure Regulation) imposes non-financial transparency requirements on financial entities and products, in a double materiality approach. This dual approach, which is specific to Europe, incorporates both the impact of external environmental and social factors on the company’s activity (financial materiality) and the company’s impact on the environment and society (impact materiality).As on a European scale, in 2020, the residential sector alone accounted for 12% of Europe’s greenhouse gas emissions involving all real estate professionals, including financial players, is crucial to transition toward a more sustainable economy[1]. The OID and the French association of real estate investment companies (ASPIM) have therefore joined forces to study how environmental and social issues are considered by French retail real estate funds following the introduction of new regulatory requirements.

SFDR regulation: the new European standard in terms of extra-financial transparency?

In order to decipher trends in the French retail real estate fund market, the public documentation of 120 funds (annual report, pre-contractual documentation, website), representing 83% of the market by value, was analysed. In addition, interviews were conducted with eight portfolio management company managers to gain a better understanding of the issues. The conclusions on the appropriation of the SFDR Regulation are therefore based on these two approaches. Quantitatively, the first observation is the greater classification of funds. While almost 10% of funds (by value) had not selected a category the previous year, almost all of them now indicate their SFDR Article, based on their consideration of environmental and social issues:

- Article 6 for funds that do not take sustainability into account,

- Article 8 for funds promoting environmental and/or social characteristics and Article 8+ for funds with a sustainable investment component,

- Article 9 for funds pursuing a sustainable investment objective for their entire portfolio.

A second observation is the significant increase in Article 8+ funds (plus 33 points in value). This increase can be explained in two ways. Firstly, the pursuit of sustainable investment means that these funds can be offered to customers who request them, as required by the European MIFiD II directive on the distribution of financial products. Secondly, the templates in the SFDR Regulation have only been mandatory since 2023, which makes it easier to understand which funds are Article 8+ funds.

These compulsory templates in the pre-contractual and periodic documentation for all financial products in the European Union harmonise the presentation of extra-financial performance (environmental or social characteristics, sustainable investment, principal adverse impacts, compliance with the OECD, etc.). This harmonisation makes it possible to compare vehicles based on quantitative criteria (taxonomic alignment, principal adverse impacts) and qualitative criteria (type of sustainable investment pursued, characteristics promoted, etc.). The three main SFDR classifications (Articles 6, 8 & 9) are now known and identical in all Member States. However, the application of the SFDR Regulation is not without its limitations. Although the classifications are intended as transparency requirements, they are interpreted by the market as labels.

An Article 8 fund will be considered as having a better extra-financial performance, whereas this is simply a choice of level of transparency. Fund managers are free to decide how to classify their funds. To date, there is no binding common definition of sustainable investment and no obligation to publish the principal adverse impacts. The European Commission has therefore identified a risk of greenwashing due to misinterpretation of the regulations. A recast of the SFDR Regulation was announced in December 2022 by Commissioner Maired McGuiness. Several local European regulatory authorities have come out in favour of changes to the SFDR Regulation, including the French Authority on Market Regulation (AMF) in February 2023 in a position paper. Finally, two public consultations have been launched : a joint consultation between April and July 2023 by ESMA and a target consultation between September and December 2023 by the European Commission. The latter consultation raises the possibility of abolishing the current classifications (Articles 6, 8 & 9) and replacing them with other sustainable investment categories, some of which would be based on the European Taxonomy.

European taxonomy: the new harmonised European sustainability reference framework?

Regulation 2020/852 sets an environmental Taxonomy that indicates which economic activities can be considered sustainable. As a new benchmark for sustainability, property funds have been required to publish their percentage of sustainable activity since 2023[2].

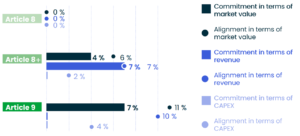

Our study of French property funds confirms the elitism of the Taxonomy. This year, players had to commit to a percentage of taxonomic alignment on one indicator, and then publish their actual alignment on the three regulatory indicators in their periodic documentation. Whether in terms of sales, capital expenditure or operating expenses, the commitment and alignment of financial flows with the Taxonomy is fairly low (see graph below).

Fig. 1: Comparison between taxonomic commitments and actual declared alignment for the different classified SFDR funds

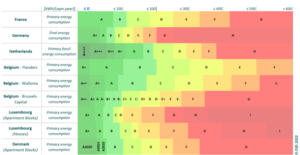

These alignment percentages can be used to make comparisons between French retail real estate funds, but also with European vehicles. However, this comparison remains limited. The EU Taxonomy proposes a common regulatory benchmark, applied by means of a Regulation, thus eliminating the need for transposition into national law. This seems to create the ideal conditions for harmonisation. However, disparities remain in the interpretation of the alignment criteria (substantial contribution and Do No Significant Harm). In addition, the comparability of the tools used, such as Energy Performance Certificates (EPC), is often hampered, as shown in the ESREI graph below comparing different EPCs. These discrepancies call into question the full effectiveness of the Taxonomy as a harmonisation tool, underlining the need to resolve these inconsistencies to achieve true uniformity across Europe.

Fig. 2: Energy bands and their thresholds for EPCs in several Member States that employ measurement scales in kWh/(sqm.year) for residential buildings. Source: OID, 2022.

The evolution of the European regulatory landscape has considerably increased the requirements in terms of extra-financial transparency. Despite the introduction of a harmonised model such as the RTS templates of the SFDR Regulation, significant challenges remain in terms of comparability between European players. The diversity of methods and tools on which these regulations are based, such as Energy Performance Certificates, underlines the urgent need for greater harmonisation. To create an environment where investors can truly assess and compare the extra-financial performance of funds from one country to another, it is imperative to standardise these methods and tools across the European Union. This harmonisation is essential to guarantee transparency, foster investor and retailer confidence and redirect financial flows towards the ecological transition.

Link to our study on real estate funds [in French]

Link to the EPC studies [in English]

Link to our Taxonomy guide here [in English]

[2] For more information, consult our Taxonomy guide here.