Article written by Armand Ritouet

European policies on renewable energy are among the most ambitious in the world. The European Union has adopted a strengthened legislative package, notably the Renewable Energy Directive (RED III, 2023), which sets a binding target of 42.5% renewable energy in the EU’s gross final energy consumption by 2030, along with an indicative target of 49% for final energy consumption in buildings. It is important to note that energy is a shared competence between Member States, which means they can only legislate on a subject if the EU has decided not to do so or has not yet done so.

The solarisation of buildings is also becoming a key focus with the 2024 recast of the Energy Performance Building Directive (EPBD), which introduces a requirement for the gradual deployment of solar installations. This is a major concern for the real estate sector (building owners, developers) but also for the solar industry, as it influences demand for solar panels and how buildings are designed and renovated.

Against this backdrop, how is the sector evolving? Does Europe have the means to achieve its ambitions? To answer these questions, ESREI studied the renewable energy context in 5 European countries, with a special focus on their targets for the building sector, as well as solarisation requirements on buildings. Let’s look at our key findings for France, Germany, Spain, The Netherlands and United-Kingdom.

Policy coherence and market dynamics

In terms of policy coherence, the results are encouraging. Today, European policies are managing to maintain consistency between Member States in terms of targets and indicators, which ensures coherence at European level, except for the United Kingdom, which has set fewer targets and monitors fewer indicators.

National Energy and Climate Plans (NECPs), for instance, play a key role in translating EU objectives into national action. Moreover, EU-level strategies such as the REPowerEU target by 2030 (install 600GW of solar energy) and the EU solar strategy are creating positive market signals for the industry. They offer a clear context for investors at European level, with regular milestones and long-term objectives. Finally, concerning the solarisation obligation, the requirements of the EPBD are beginning to be implemented in France and Germany. This is not planned in Spain and the Netherlands yet. The United Kingdom will introduce a solarisation obligation in 2025.

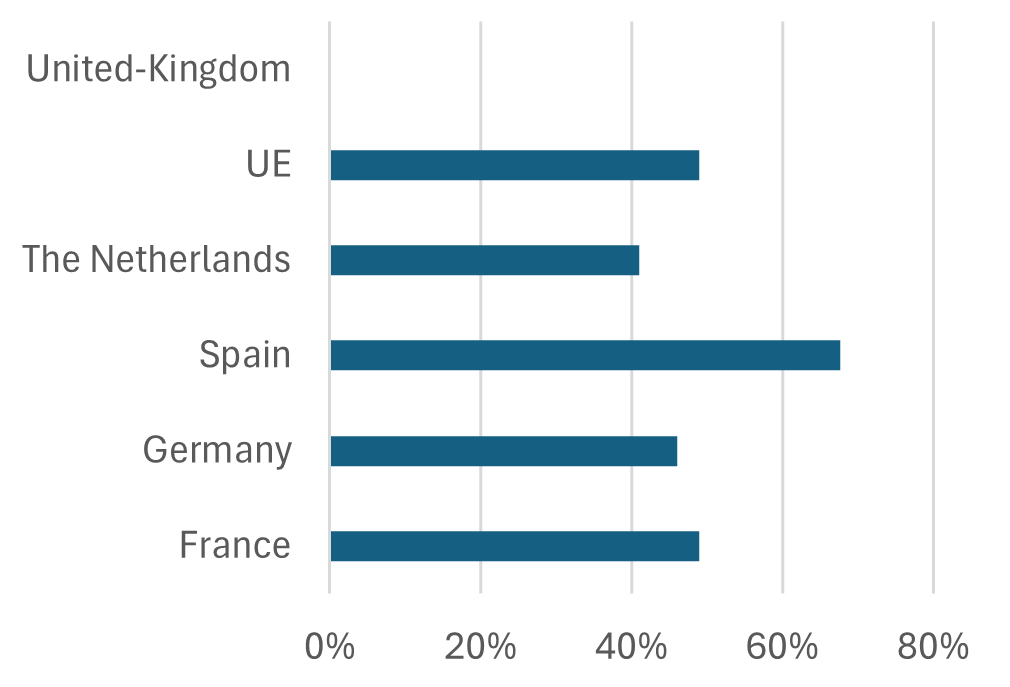

Figure: Renewable energy target in final energy consumption in buildings in 2030. The UK as not set a target. Source: OID.

Risks and structural dependencies

Between 2021 and 2023, the renewable energy sector experienced years of prosperity, fueled by higher energy prices and growing concerns over energy security. The photovoltaic market, for example, recorded annual growth rates between 45% and 50%. Although the renewable energy sector experienced a significant slowdown in 2024, the installed capacity is still increasing (+16% in 2024), mainly driven by solar power.

However, the market faces major challenges. One of the most significant is Europe’s growing dependence on Asia, particularly China. While Germany was the world leader in solar energy around 15 years ago, China now produces more than 95% of the wafers needed to manufacture photovoltaic panels and hold a significant technological lead over European countries. This dominance, combined with intensive social and environmental dumping, enables China to produce at very low costs. In 2022, Chinese panels were a third cheaper than those manufactured in Europe, and their price fell by 40% in 2023. Furthermore, the current political uncertainty and setbacks in environmental policies threaten investment in the sector, for example with the Omnibus Package. Finally, the electrification rate of the Union is too slow, almost stagnating for the past five years. The integration of renewable energy in the economy depends on this electrification rate.

The success of the REPowerEU plan -and Europe’s broader energy transition- hinges on whether regulators can step up to shield and strengthen the renewable energy sector in the face of mounting pressures, from global competition to policy uncertainty.

To know more about renewable energies in the building sector in Europe, please check out our resource Renewables and solarisation in Europe, Overview of 5 European countries.