Germany has been applying a cost to greenhouse gas emissions in the heating sector since 2021. Focus on a scheme that is expected to soon be extended to the entire EU.

A Blank Space

Germany, like all EU Member States, participates in the European Union Emissions Trading System (EU ETS), which sets an overall limit on greenhouse gas emissions from power plants, energy-intensive industries, and intra-European commercial aviation. This mechanism is one of the tools available to the EU to achieve its decarbonisation goals: reducing its emissions by 55% by 2030 compared to 1990 levels, aiming for carbon neutrality by 2050.

However, this system does not apply yet to two sectors heavily reliant on fossil fuels: transportation and buildings. Heating and transportation, in fact, are among the primary needs for fossil fuels such as domestic heating oil, natural gas, gasoline, and diesel. In Germany, these sectors accounted for more than a third of greenhouse gas emissions in 2022.

Germany has sought to address this gap since 2019. After lengthy deliberations, it opted to establish a national emissions trading system (nationales Emissionshandelssystem, nEHS) for the heating and transportation sectors. Additionally, choosing an emissions trading system ensures compatibility with the EU ETS. Moreover, the experience of the French government during the « yellow vests » protests encouraged the German government to avoid potential tax measures. This system, which was part of the Fuel Emissions Trading Act (Brennstoffemissionshandelsgesetz – BEHG), came into effect in 2021.

The German System

The nEHS operates on the principle of cap-and-trade. The maximum quantity of greenhouse gases that can be emitted (cap) is determined at the policy level. Emissions trading on the market (trade) helps determine a price for this scarce commodity. The annual cap on permitted greenhouse gas emissions is set in line with EU regulations.

Initially though, the nEHS is not strictly an emissions trading market but a hybrid pricing system involving fixed-price emissions trading. Eventually, the Fuel Quota Trading Act envisages the establishment of a market-based emissions trading system, but until 2025, the fixed-price phase establishes a system equivalent to a tax or levy.

The government expected the system to generate revenues of 40 billion euros from 2021 to 2024 (the budget planning period at the time). Revenues are directed to the Climate and Transformation Fund (KTF), which funds initiatives such as energy-efficient building renovations, boiler replacements, support for renewable electricity feed-in, and the expansion of electric mobility infrastructure.

Tenant-Landlord Distribution

Effective from January 2023, the Carbon Dioxide Cost Allocation Act (“Kohlendioxidkostenaufteilungsgesetz,” CO2KostAufG) arbitrates the sharing of carbon-related costs between tenants and landlords.

Energy providers are now required to specify the carbon-related costs on their bills. These costs are distributed according to the extent of greenhouse gas emissions originating from the building, which can be determined by the building’s fuel consumption.

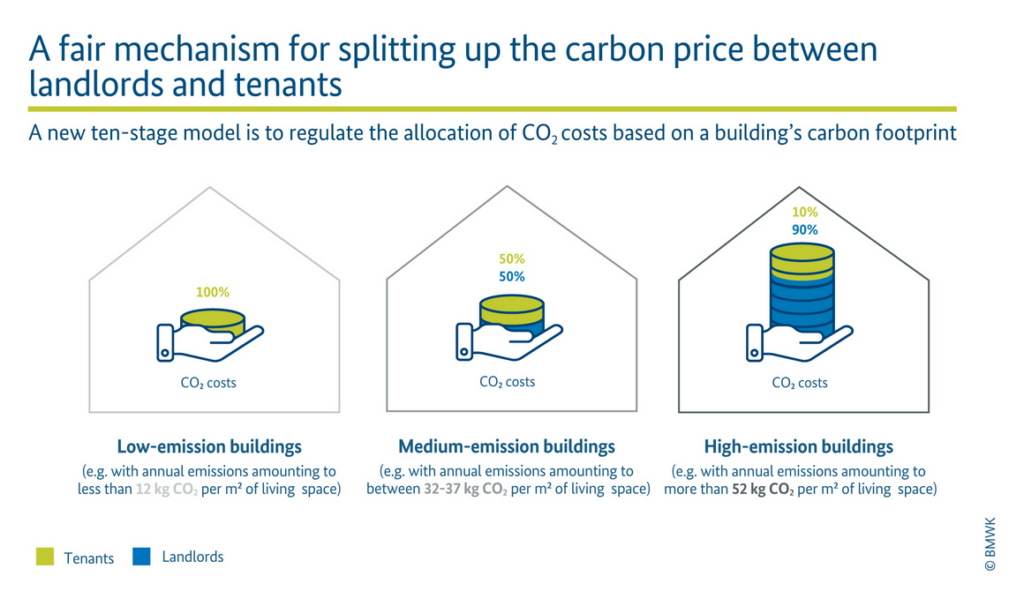

The distribution of carbon dioxide costs is determined by the energy quality of the building. The better the condition of the building, the lower the share of the landlord and the higher the proportion for the tenant. The energy quality of the building is determined based on the annual carbon dioxide emissions per square meter of living space per year. Cost-sharing proportions are determined according to a specific scale. Here are some examples of repartition:

Figure 1: Ten stages for a fair carbon price, source: Federal Ministry for Economic Affairs and Climate Protection

In order to allow for a detailed analysis towards cost sharing process, a tool has been developed by the German government which is designed for calculation and distribution of carbon dioxide costs.

Ahead of the EU

The European system is set to evolve: the European Union will create a second carbon market specifically for building heating and road transport. The price on this second system, launched in 2027, will not exceed 45 euros per tonne of CO2 at least until 2030.

The German system will then merge into this new market, but other European countries may face a potentially more abrupt transition. The German case is thus particularly interesting as it serves as a kind of laboratory for the various issues that may arise.

Thank you to all our sponsors !

ESREI is now sponsored by AEW, Amundi Asset Management, Axa Investment Managers, BNP Paribas Real Estate, CBRE Global Investors, Ivanhoe Cambridge, La Française REIM, Mazars, Ofi Invest and Pimco Prime Real Estate. Contact the ESREI team at esrei@o-immobilierdurable.fr if you are interested to join us!