Founded in 2007, the DGNB is a non-profit association, with more than 2.700 member organisations, whose goal is to actively shape the transformation of the construction and real estate industry, to promote understanding of the need for sustainable building and to anchor it in the consciousness of the general public.

Dr. Christine Lemaitre studied civil engineering at the University of Stuttgart and began her career as a structural engineer in the United States. In 2003, she became a research associate at the University of Stuttgart, before joining Bilfinger Berger AG in 2007 as a project manager. She completed her PhD in 2008. At DGNB, she first led the “System” department and has served as CEO since February 2010. She previously sat on the board of the World Green Building Council and currently chairs both the Climate Positive Europe Alliance and the Wissensstiftung. She is also a member of the Advisory Board for Building Culture of Baden-Württemberg, the Sustainability Council of the German Property Federation (ZIA), and Chair of the Board of Directors at the Cradle to Cradle Product Innovation Institute.

How do you picture the sustainability landscape for real estate in your country? What aspects of ESG dynamics are currently the best integrated? Conversely, which aspects remain the least integrated?

Similarly to other European countries, German real estate companies feel they now have a good grasp on environmental aspects. However, the reality is more complex: while progress has certainly been made, many challenges remain on the environmental front, given the vast scope of the topic. Within the environmental pillar, some issues are progressing at very different paces: CO₂ concerns, for example, have long been driven by energy efficiency issues and are now primarily influenced by European regulations. Meanwhile, biodiversity still remains a relatively underexplored area.

Governance aspects are already well-framed by regulations and established standards within the German context, which is why they are not currently at the core of ESG discussions.

The most unresolved component of ESG is undoubtedly the social pillar. Real estate companies are still trying to define what it means in practice and how it can become a material part of their strategy. It remains the most evolving theme within ESG today.

What are the key regulatory deadlines or developments in 2025 that you are monitoring in relation to sustainable real estate in your country?

Regulatory developments in real estate are currently difficult to anticipate.

Firstly, because the framework has recently been updated — partly to align with European requirements. The Gebäudeenergiegesetz (GEG), or Building Energy Act, is one of the key regulations setting ESG requirements at the building level was revised in 2024.

Secondly, the political uncertainty that has lingered since the last legislative elections continues to cloud and slow down clear regulatory direction.

What are the key voluntary deadlines or developments in 2025 that you are monitoring in relation to sustainable real estate in your country?

The current uncertainty is also affecting market-driven ESG initiatives, and there are no major voluntary ESG developments currently on the horizon.

In our opinion, if one should emerge, it should be the transition from a theoretical approach to a more reality-based one. The German market still relies too heavily on theoretical frameworks, and this transition may need to be driven by voluntary actors. For example, Germany still lacks a centralized EPC (Energy Performance Certificate) database — a project that could become a significant next step, whether through market forces or regulation. The DGNB aims to play a key role in this transition, notably through the revision of its “Building In Use” scheme, which is being reworked to serve as a tool for analysing and monitoring both environmental and social building performance.

Could you outline the main elements of your events and publications calendar for 2025?

The DGNB has several projects underway in the first half of the year.

The EU Council is raising its ambitions and standards regarding carbon targets. The latest version of the Energy Performance of Buildings Directive (EPBD) has introduced significant updates to the sustainable framework, and Germany has set its own carbon neutrality goal for 2045. To help achieve this, DGNB is currently updating its “net zero carbon” definition for buildings to be found within our Carbon Neutral Building Toolbox, which provides guidance for designing, operating, and managing carbon-neutral buildings.

Toolbox « Carbon neutral building »

By 2045, the entire building stock in Germany must become carbon neutral. A building is carbon neutral in the sense of the DGNB if the « annual balance of emissions emitted by building operation and emissions avoided by generation of CO2-free energy exported off site is zero or less than zero. » In order for this transformation to succeed, we have compiled a toolbox that provides relevant stakeholders in the construction and real estate industry with key information, recommendations for action and instruments to help shape the process and plan, construct and operate buildings and districts in a carbon neutral manner.

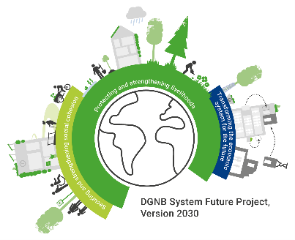

We do also focus on broader sustainability goals with a shorter time horizon, especially with the fast-approaching milestone of 2030. In that regard, DGNB has developed its DGNB System Future Project as a roadmap for the decade ahead.

DGNB System for the Future Project

In addition to other certification variants, the DGNB System for the Future Project, Version 2030 is a supplementary offer for particularly ambitious existing buildings. Certification is also possible for new builds. It can be used as an alternative or as a complement. The DGNB System for the Future Project sets high standards for sustainable buildings and requires a willingness to seek new solutions and act as a role model.

Lastly, as in the rest of Europe, DGNB is closely following developments in sustainable investment and reporting regulations — particularly in light of recent announcements linked to the Omnibus legislative package.

Finally, in your opinion, what are the key trends likely to shape the real estate sector in the coming years?

Several emerging trends are likely to shape the future of real estate in relation to ESG.

The first is a shift in key drivers. There’s a growing disconnect between the political sphere and market dynamics. Legislative and regulatory forces may no longer be the main drivers in every area. In terms of reporting, for example, many banks and financial institutions have already defined their ESG criteria and roadmaps — and recent political rollbacks, like the Omnibus revisions, are unlikely to reverse this trend. DGNB has begun collaborating with financial institutions on a joint initiative to track ESG performance — projects like this could define a new kind of market leadership. Cities are also emerging as powerful drivers of change. They are responding more quickly to ESG demands and showing greater innovation.

The second major trend is the growing attention to less explored ESG topics — especially social impacts. Many challenges exist in this area, and one of the key tensions lies in the perceived conflict between environmental ambitions and social outcomes. This could be the first barrier to overcome, especially as the cost of a project is not necessarily correlated with its environmental ambition. This opens the door for better alignment between environmental and social goals.

ESREI wishes to thank Christine Lemaitre and Christine Schröder from the DGNB for their availability and the time they dedicated to this publication.